Mahama Delivers on Promise: Signs Bills to Abolish E-Levy, Betting Tax, and More

In a move to ease the financial burden on Ghanaians, President Mahama fulfills his election pledge by eliminating controversial taxes, including the E-Levy and Betting Tax

- The move aligns with NDC’s promise to reduce financial burdens on Ghanaians

- The E-Levy, introduced in 2022, was widely unpopular and faced public resistance

- The E-Levy, introduced in 2022, was widely unpopular and faced public resistance

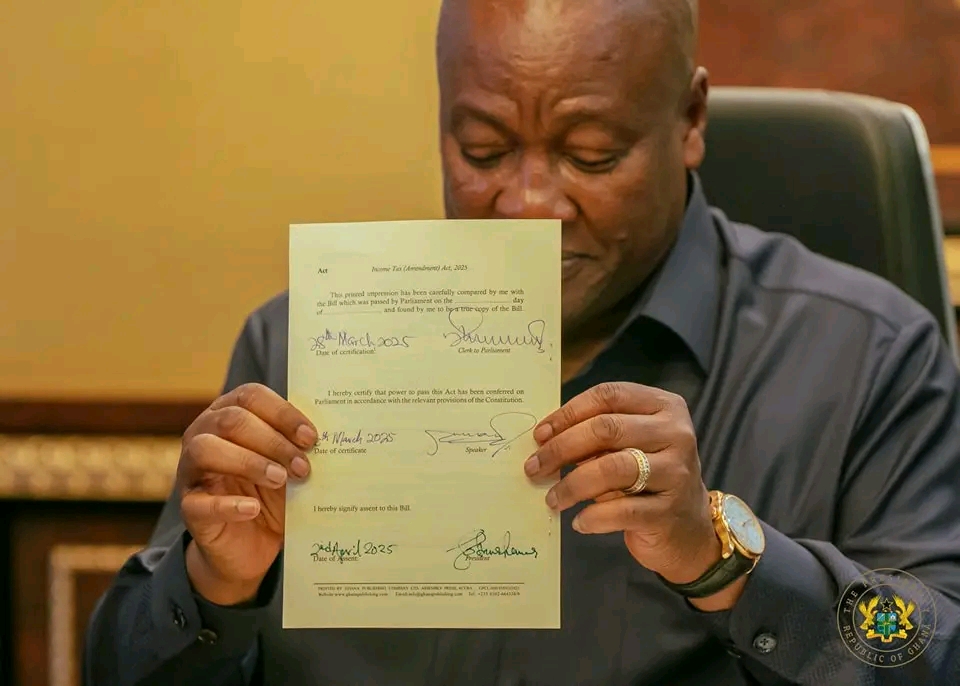

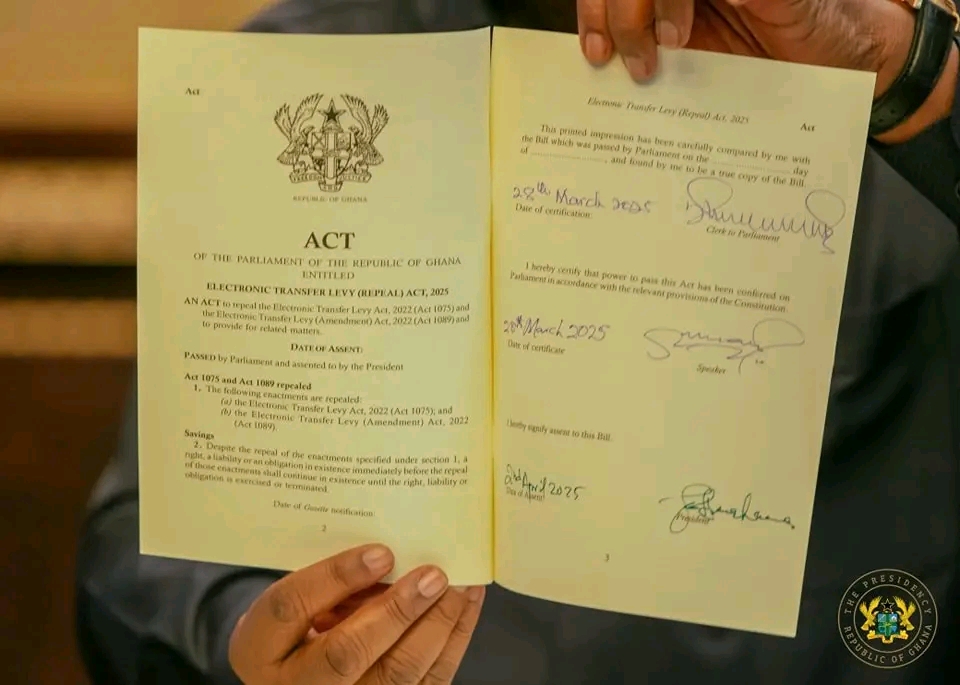

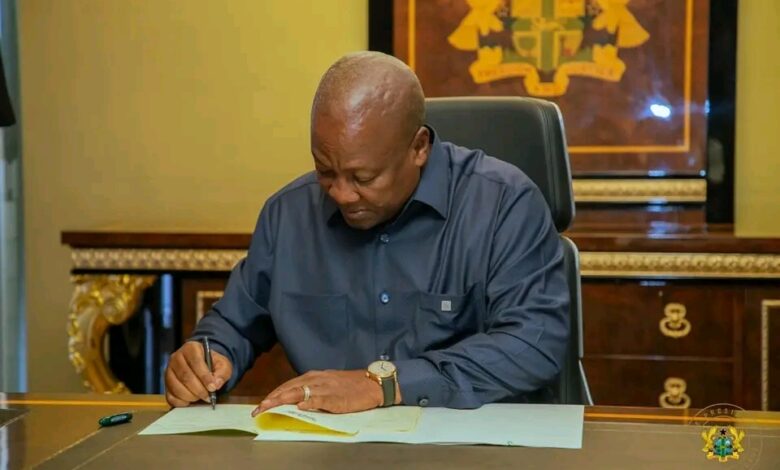

President John Dramani Mahama has officially assented to a series of landmark bills that will abolish several taxes, including the Electronic Transfer Levy (E-Levy), Betting Tax, and Emissions Tax, fulfilling his pledge to ease the financial burden on Ghanaians.

On March 13, 2025, Finance Minister Dr. Cassiel Ato Forson presented eight key bills to Parliament aimed at repealing or amending a range of taxes and levies.

These included the Electronic Transfer Levy (Repeal) Bill, 2025; Emissions Levy (Repeal) Bill, 2025; Income Tax (Amendment) Bill, 2025; and the Earmarked Funds Capping and Realignment (Amendment) Bill, 2025, among others.

The controversial E-Levy, introduced in 2022, imposed a 1% charge on electronic transactions such as mobile money transfers and online payments, and was met with public outcry due to its impact on disposable income.

Similarly, the Betting Tax, which took a 10% cut from gambling winnings, was widely criticized within the gaming industry.

Ahead of the 2024 general elections, Mahama had promised to abolish these taxes within his first 120 days in office if elected. With the signing of these bills, his administration has now delivered on that campaign pledge, marking a significant shift in Ghana’s tax landscape.