The Ghana Revenue Authority (GRA) has issued an urgent directive to all entities involved in Electronic Transfer Levy (E-Levy) charges, instructing them to immediately adjust their systems to reflect the levy’s abolition.

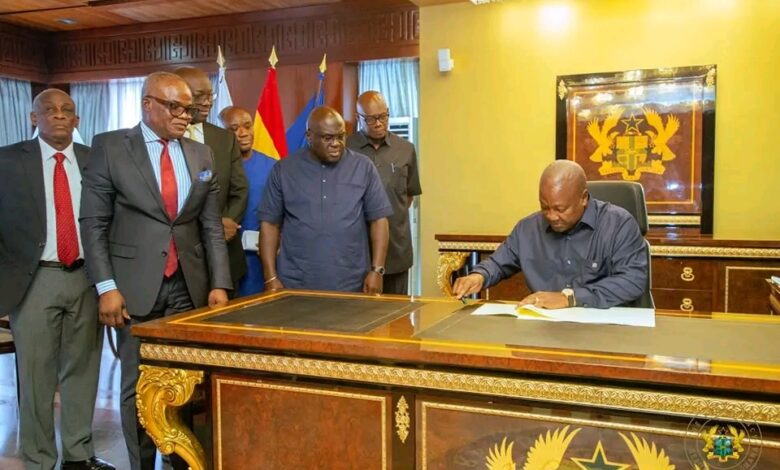

This follows President John Dramani Mahama’s formal approval of legislative bills on April 2, 2025, which have abolished not only the E-Levy but also other taxes, including the Betting and Emissions Taxes.

In an official announcement, the GRA confirmed that the Electronic Transfer Levy Act, 2022 (Act 1075) and its amendment (Act 1089) have officially become law, eliminating the 1% E-Levy as of April 2, 2025.

The GRA has laid out clear instructions for entities to implement a “no charge” configuration on their systems immediately.

These measures include halting the 1% E-Levy charge, issuing refunds for any fees deducted from customers since the law’s enactment, and ensuring all transactions continue to be posted to the GRA’s management system until further notice.

Non-compliance with these instructions will result in legal consequences, with the GRA conducting regular checks to enforce adherence. Entities can seek further assistance from the E-Levy Technical Support Team via email.