Francis-Xavier Sosu, Four Other NDC MPs Introduce Private Member’s Bill to Repeal Betting Tax

MPs argue that removing the 10% tax on gaming winnings would reduce financial strain and encourage economic growth

- MPs argue that the 10% tax on betting winnings increases financial hardship for Ghanaians

- The proposed bill aims to remove the tax to encourage financial freedom

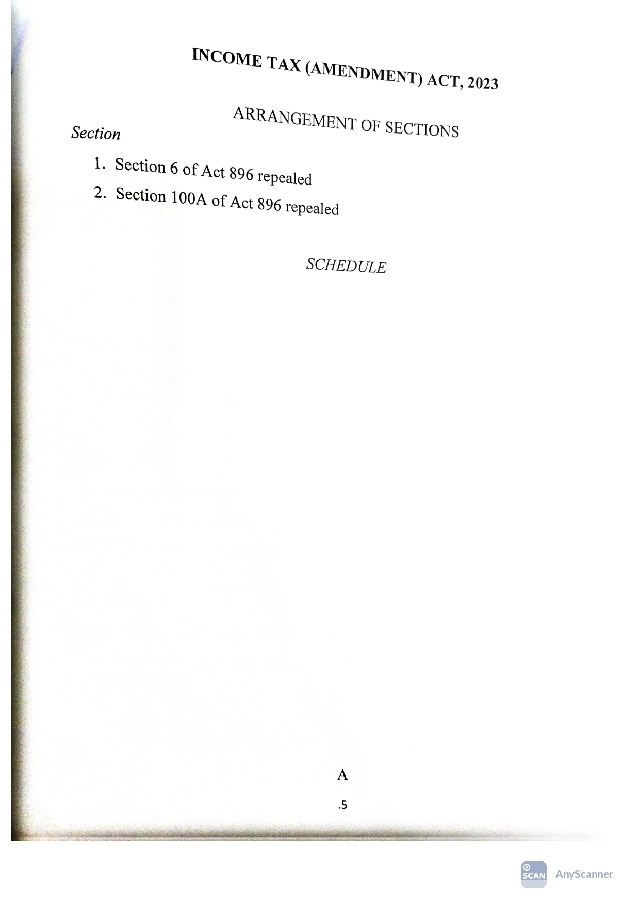

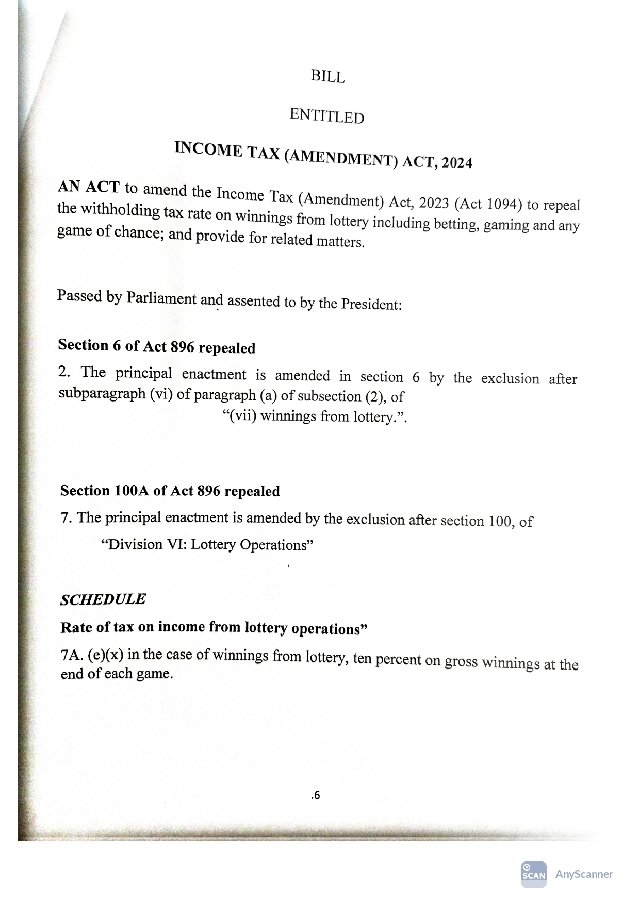

- Implemented in August 2023, the tax replaced a prior 15% VAT

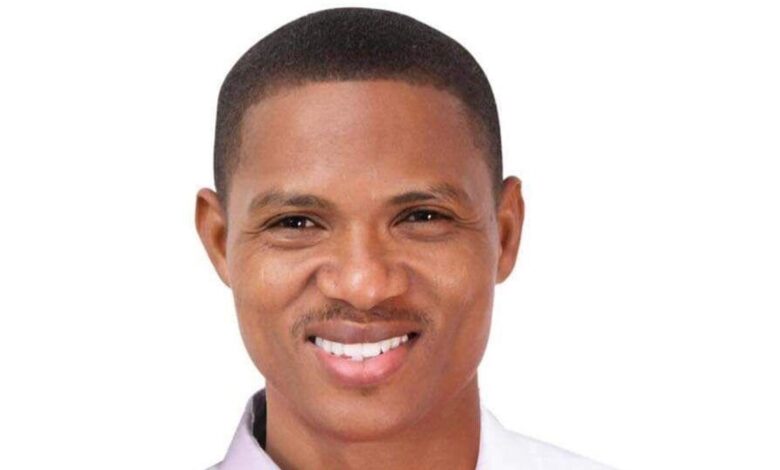

Madina MP Francis-Xavier Sosu, alongside four other members of Parliament, has put forward a private member’s bill to abolish the 10% withholding tax on betting and gaming winnings.

In their letter to the Clerk of Parliament, dated November 7, they argued that this tax adds to the financial challenges facing many Ghanaians, particularly given the economic strains from the Domestic Debt Exchange Programme (DDEP).

The MPs highlighted that the tax on gaming winnings exacerbates economic hardships, limits citizens’ financial choices, and worsens unemployment.

They believe that removing this tax would help lower living costs, support savings and investment, and foster economic stability.

Since August 15, 2023, this withholding tax has replaced the previous 15% VAT on gaming stakes as part of the 2023 amended Income Tax Act (Act 1094). The MPs argue for its removal as a necessary relief measure in light of the nation’s economic challenges.